Under the current tax system in China, there are different types of taxes that a single or a company pay. The individual income tax is one of the most important. And in the Chinese taxation system is also mentioned the annual tax return. Usually, most employees have their income tax deducted each month from their salary by their employer. But there are certain types of residents that must file an annual reconciliation tax return on comprehensive income.

In this article, we want to explain what are the different ways to file an individual tax return in China.

What is the Annual Tax Return?

This is the act of calculating the annual final individual income tax payable for the whole year after combining the income from wages and salaries, remuneration for labor services, author’s remuneration, and royalties obtained in a tax year.

From those, you then deduct the tax paid in advance in the tax year, calculate the refundable or supplementary tax payable, report to the tax authorities and make the tax settlement.

Should I apply for it?

In some situations you don’t have to apply for the annual tax return:

- For non-residents who have resided in China for less than 183 days, there is no need to declare;

- For residents, there are four situations for which you don’t need to declare:

- The total annual income from comprehensive income in the previous year does not exceed RMB 120,000;

- The amount of supplementary tax payable for the year does not exceed RMB 400;

- The advance payment of individual income tax in the previous year is consistent with the annual payment of individual income tax;

- Giving up the application for the tax return.

Except for the listed situations you should do the declaration in time.

When can I apply for it?

From April 1st to June 30th of the current year.

What are the consequences if I don’t declare on time?

If the taxpayer needs to pay tax (except in the case of exemption from remittance according to the provisions) and fails to handle the annual tax return according to the law, it may be subject to tax administrative punishment and shall be recorded in the personal tax credit file.

In accordance with article 62 of the law on the administration of tax collection, if a taxpayer fails to file tax returns and submit tax payment materials within the prescribed time limit, the tax authorities shall order to make corrections within a prescribed time limit and may impose a fine of not more than 2,000 yuan.

If the circumstances are serious, a fine of not less than 2,000 yuan but not more than 10,000 yuan may be imposed, and a late fee is imposed too.

Ways to file the annual tax return in China

There are three ways that you can use to apply for the annual tax return in China:

- Apply through your employer

- Apply through a third-party agency

- Apply on the “个人所得税” APP by yourself (PS. The app has only the Chinese version)

Continue to read below for more details about the three ways.

Apply through your employer

In this situation, there are two steps that the employee has to follow:

- Before April 30th, the employee submits an application to the employer and signs a confirmation letter to entrust the company to handle the individual income tax return.

- The employee should provide complete and accurate income information to the company, and the company will analyze the different situations of the employee and choose the best way to declare.

Normally, for the employee that obtains only the domestic comprehensive income, the company will declare through government’s website.

For the employee that obtain overseas comprehensive income, the company should go to the tax bureau and submit some documents to the counter such as the annual individual income tax return form (form B) (《个人所得税年度自行纳税申报表(B表)》) and individual income tax credit details (《境外所得个人所得税抵免明细表》) for overseas income, original passport and the letter of authorization with employee’s signature.

Note: the documents required are different for each district.

Apply through a third-party agency

In this situation, there are three steps that the employee has to follow:

- The employee searches for a third-party agency and signs a contract with the agency to entrust them to handle the individual income tax return

- After signing the contract, the employee login into the APP to manage the agency relationship with the effective operation date and contract number and other information including the name and tax number of the agent company. Then the agency can complete the process.

- The employee should provide complete and accurate income information to the agency, and the agency will analyze the different situations of the employee and choose the best way to declare

Normally, for the employee that obtains only the domestic comprehensive income, the agency will declare through government’s website.

For the employee that obtain overseas comprehensive income, the agency should go to the tax bureau and submit some documents to the counter such as the annual individual income tax return form (form B) (《个人所得税年度自行纳税申报表(B表)》) and individual income tax credit details (《境外所得个人所得税抵免明细表》) for overseas income, original passport and the letter of authorization with employee’s signature.

Note: the documents required are different for each district.

Gathering Required Documents and Information

A. Personal Identification Documents

Personal identification documents are essential for individuals when filing their annual tax returns in China. These documents serve as proof of identity and help establish the taxpayer’s personal information. Common identification documents include the national identification card or resident permit for Chinese citizens, and the passport for foreigners residing in China.

These documents provide crucial information such as name, date of birth, and identification number, which are required to accurately identify and verify the taxpayer’s identity. It is important to ensure that these identification documents are valid and up-to-date when preparing and submitting the annual tax return to maintain compliance with tax regulations.

B. Income and Expense Records

Maintaining accurate income and expense records is crucial for individuals when preparing their annual tax returns in China. Income records include documents such as salary statements, bank statements, and receipts from freelance work or rental income. These records help determine the total income earned during the tax year.

Expense records, on the other hand, include receipts or invoices for deductible expenses such as medical expenses, education expenses, and housing loan interest payments. By keeping detailed and organized income and expense records, individuals can ensure they claim the appropriate deductions and accurately calculate their taxable income, resulting in a more accurate and compliant annual tax return.

C. Deductible Expenses and Tax Credits

Deductible expenses and tax credits play a significant role in reducing an individual’s tax liability when filing the annual tax return in China. Deductible expenses are specific costs that can be subtracted from the total income, thereby lowering the taxable income. These expenses can include items such as medical expenses, education expenses, housing loan interest payments, and charitable donations.

On the other hand, tax credits directly reduce the amount of tax owed. China offers various tax credits, such as those for supporting elderly parents, hiring disabled individuals, or conducting research and development activities. By understanding and accurately claiming deductible expenses and tax credits, individuals can optimize their tax situation and potentially receive significant tax savings.

Calculating Taxable Income

A. Different Types of Income

Different types of income need to be considered when filing an annual tax return in China. These income sources can include employment income, business income, rental income, investment income, and other miscellaneous sources. Employment income refers to wages, salaries, and bonuses received from employment. Business income encompasses income generated from self-employment or operating a business. Rental income pertains to earnings from renting out properties.

Investment income includes dividends, interest, and capital gains from investments. It is essential to accurately classify and report each type of income to ensure compliance with tax regulations. Different types of income may be subject to varying tax rates, deductions, or exemptions, so understanding their classification is crucial for an accurate tax return.

B. Exemptions and Taxable Income Thresholds

Exemptions and taxable income thresholds play a significant role in determining the tax liability of individuals when filing their annual tax returns in China. Exemptions are specific amounts that can be subtracted from the taxable income, reducing the overall tax burden. These exemptions can include personal exemptions, dependent exemptions, and special exemptions for certain circumstances such as disabilities or medical expenses.

Additionally, China imposes different taxable income thresholds, below which individuals may be exempt from paying taxes. Understanding these thresholds and exemptions is crucial for accurately calculating taxable income and ensuring compliance with tax laws. Properly applying exemptions and considering taxable income thresholds can result in significant tax savings for taxpayers.

C. Tax Rates and Brackets

Tax rates and brackets determine the amount of tax individuals are required to pay on their taxable income when filing their annual tax returns in China. The tax system in China operates on a progressive tax rate structure, which means that as the taxable income increases, the applicable tax rate also increases. The tax rates are divided into different brackets, with each bracket having a specific tax rate. The tax brackets and rates are periodically adjusted by the government.

Understanding the current tax rates and brackets is crucial for accurately calculating the tax liability and ensuring compliance with tax regulations. It is important to properly apply the correct tax rate for each income bracket to avoid underpayment or overpayment of taxes.

Apply on the “个人所得税” by yourself

Step 1 – Login and preparatory work

Download and open the【个人所得税】APP and make sure you have updated to the latest version.

P.S. Foreign individuals need to get the login code at the tax bureau counter. Be sure to register with the same name that you used to register your bank card.

After you receive the code from the tax bureau, open the app and click【个人中心】. Then click【登录/注册】on top to start the registration process.

Click【注册】and then【大厅注册码注册】.

Fill in the information required:

- Login code from the tax bureau【注册码】

- Select the document【证件类型】. Make sure to select passport 【外国护照】

- Enter your passport number 【证件号码】

- Enter your full name 【姓名】

- Enter your nationality 【国籍】

In the end, click on the button【下一步】.

In the last step, choose your password【密码】, input your phone number 【手机号码】. Click on the button 【获取验证码】 to receive the verification code by message on your phone. Then choose your address in the last field.

After you finish all the steps, you should see the message【注册成功】and after that you can log in with your phone number and password.

Step 2 – Bind bank card

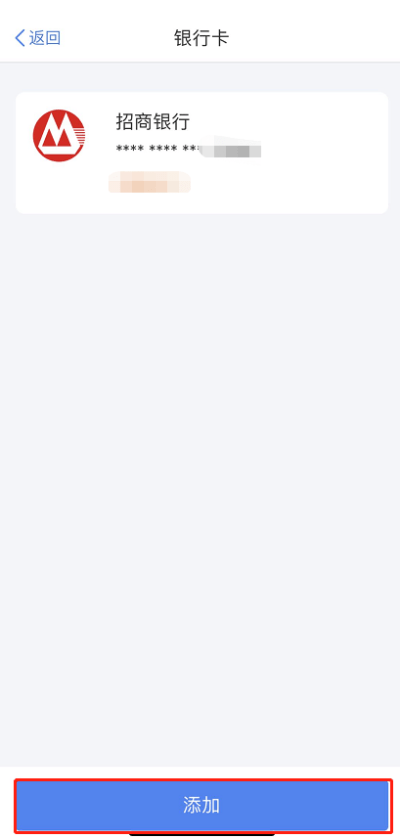

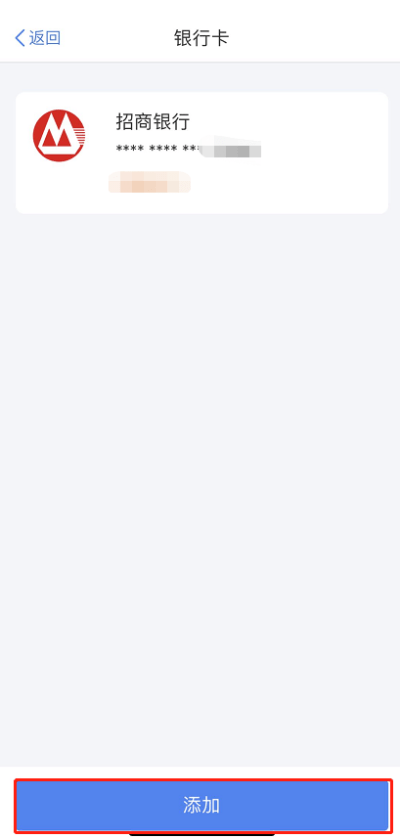

In your personal profile, click 【银行卡】and then the blue button at the bottom to add a new card.

P.S. This card is used for tax return or payment.

Fill in the information of the bank card. The name is automatically filled in after the sign-up procedure. Then you have to fill in the required information:

- 【银行卡号】 – Number of the bank card

- 【所属银行】 – Name of the bank

- 【开户银行所在省份】 – Province where the bank is located

- 【银行预留手机号码】 – Phone number

Step 3 – Declaration Procedure

Click 【首页】-【常用业务模块】-【综合所得年度汇算】-【使用已申报数据填写】

(there are two ways to fill in the form. It is recommended to use the declared data or fill in the form by yourself.)

The app will ask to confirm the accumulated number of days in China in the previous year【境内累计居住天数】 and the years of continuous living in China【境内连续居住年数】.

Confirm the basic information and select 【任职受雇单位】-【下一步】

After entering the verification information page of income and pretax deduction data, please confirm:

- whether the wage and salary reporting data are completed, and whether there are other unreported incomes;

- whether the information of special additional deduction is correct. All the information of special additional deduction can be added or modified in 【专项附加扣除】(Foreigners who used living allowance in the previous year cannot use special additional deduction);

- if there are other deductions, such as an annuity, commercial health insurance, tax-deferred endowment insurance, etc., the operation shall be conducted in 【其他扣除项目】.

For example, if there is a labor remuneration income item, select【劳务报酬】-【新增】 to add.

For example, in the annual summary of annual one-time bonus, if you choose to combine the annual one-time bonus into the comprehensive income for tax purposes, or if there are multiple annual one-time bonuses, you can set it by 【奖金计税方式选择】.

After checking the information, enter the tax calculation interface. According to the data filled in before, the tax payable or tax refundable will be displayed at the bottom left. After confirmation, click 【提交申报】.

If you need to pay the tax, but the annual comprehensive income is not more than 120,000 yuan or the amount of tax is not more than 400 yuan, click 【享受免税申报】[enjoy tax exemption declaration], which means you do not need to pay the tax. Confirm to submit.

Tax return

If the declaration is successful, the refund will jump to the successful declaration — refund page, click 【申请退税】”apply for refund”. Select the bank card and click 【确定】”ok”.

Tax payment

If you need to pay tax, you can go to the tax page. Click 【立即缴税】”tax now” to pay.

Note: pay taxes by June 30th.

Submitting the Annual Tax Return

A. Filing Options: Online vs. Offline

When it comes to filing annual tax returns in China, individuals have the option to choose between online and offline filing methods. Online filing allows taxpayers to submit their tax returns electronically through designated government websites or tax filing platforms. It offers convenience, speed, and the ability to access relevant resources and guidance online. On the other hand, offline filing involves physically submitting printed forms and supporting documents to tax authorities by mail or in person. This method may be preferred by individuals who prefer traditional paperwork or have limited access to the internet. Understanding the pros and cons of both filing options can help individuals choose the most suitable method for their circumstances.

B. Deadlines and Extensions

Understanding deadlines and extensions is crucial when filing annual tax returns in China. The tax authorities set specific deadlines by which taxpayers must submit their returns and pay any taxes owed. These deadlines are typically based on the calendar year and vary depending on the type of taxpayer and filing method. It is essential to be aware of the deadlines to avoid penalties for late filing or payment. In certain circumstances, taxpayers may be eligible to request an extension to the filing deadline. This allows for additional time to prepare and submit the tax return. However, it’s important to note that extensions may not apply to the payment of taxes owed, so timely payment is still necessary.

C. Penalties for Late Filing or Incorrect Reporting

Late filing or incorrect reporting of annual tax returns in China can result in penalties imposed by the tax authorities. Failure to file the tax return by the specified deadline can lead to late filing penalties, which are typically calculated based on the number of days or months of delay. These penalties are usually a percentage of the tax owed and can accumulate over time. Additionally, providing inaccurate or false information in the tax return can lead to penalties for incorrect reporting. These penalties can be substantial and may include fines or even criminal charges in severe cases. It is important to file the tax return accurately and on time to avoid such penalties and maintain compliance with tax regulations.

Conclusion

In conclusion, understanding and navigating the annual tax return process in China is crucial for individuals to fulfill their tax obligations accurately and in compliance with tax laws. By familiarizing themselves with key concepts such as personal identification documents, income and expense records, deductible expenses, tax rates, and filing options, taxpayers can ensure a smooth and efficient filing experience. Adhering to deadlines, avoiding errors in reporting, and seeking professional assistance when needed are essential for avoiding penalties. By approaching the annual tax return process with diligence and accuracy, individuals can contribute to a fair and efficient tax system while optimizing their tax situation.

How HROne can be beneficial to you

The annual tax return in China can be a complicated process for foreigners, mainly because of the language barrier and regulations. We hope that with this guide, we were able to help you to understand more about it. In case you need help to file the annual tax return, feel free to contact us or fill in the form below.

Get the guide to hire employees in China in 2021 and stay updated on the latest news about HR, employment, and business expansion in China!

Thank you!

You have successfully joined our subscriber list. Check your email to get your copy of the guide to hire employees in China!