If your company is considering an entrance into the Chinese market, a big question may be how your company can hire a foreign employee in China. In this guide, we will explain step-by-step all the requirements involved when hiring a foreigner in China.

Introduction

The increasingly-globalized world has made it very common for companies to enter markets far from their headquarters. China is one of the most sought-after. More and more foreign enterprises are interested in employing foreign staff directly for the company’s business operation and management.

There are several methods foreign companies use to enter the Chinese market, and one of the most common is through the establishment of a WFOE(A Wholly Foreign-Owned Enterprise). For a foreign company to independently hire employees in China, a WFOE is required.

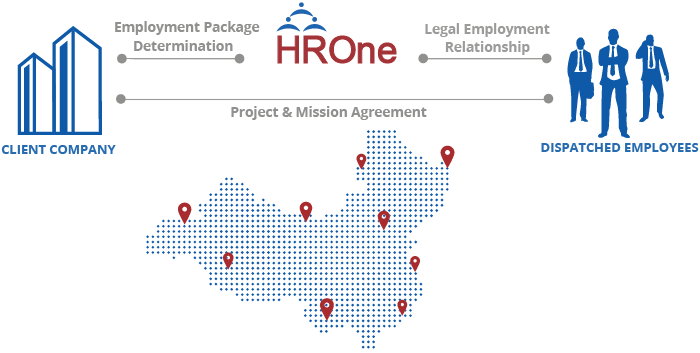

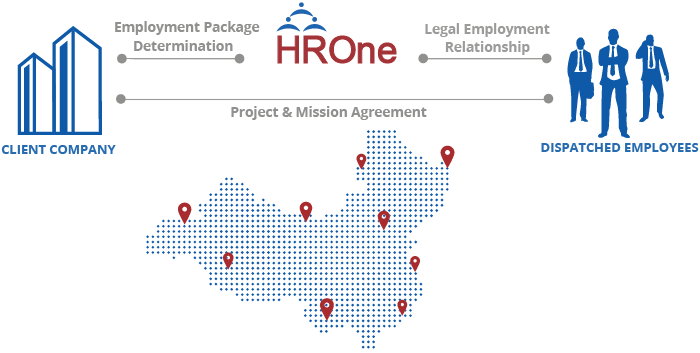

On the other hand, if a foreign company is not considering the setup of a legal entity (WFOE) and wishes to hire employees, it must hire them through a local PEO/ Employment Solutions provider.

Companies choose to use local employment solution providers in China for a variety of reasons. For some companies, they may be primarily needing short-term or single project hiring. Others may not feel it is worth the risks involved to set up a WFOE. For other companies, because the WFOE setup process can be a lengthy procedure, they choose to use a local service provider to be the entity that can hire employees on behalf of their company while the setup process is ongoing. HROne is one such company.

Hiring in a country like China, with a different system, new culture, and foreign language can seem intimidating. Fortunately for you, this is your one-stop guide to understanding the entire process, and what steps your company can take to move ahead into the booming Chinese market!

Let’s move into the more technical aspects of hiring foreign employees in China.

Basic Requirements to Work in China

According to the People’s Republic of China law, the definition of a foreigner is simple: a person without Chinese nationality. PRC law further defines those foreigners who work in China as people engaging in labor and receiving remuneration who have not obtained permanent resident status in China.

An employee who intends to work in China must meet the following requirements:

- Be over the age of 18 and be in good health;

- Have the professional skills and work experience to fill the relevant vacancy;

- Have no criminal record;

- Have a specific employer;

- Hold a valid passport and/or any other required international travel certificates.

Obtaining a Work Visa

Here is an overview of the process to obtain a Work Visa for foreign employees in China. For a more detailed understanding, see our other article.

- Apply online from outside China for a Foreigner’s Work Permit Notice;

- Apply for a Z-Class Visa at a Chinese embassy or consulate;

- Turn in Work Permit Notice and Visa Application;

- Receive the Visa and Get on the Plane to China;

- Temporary Registration with Police;

- Medical Verification;

- Acquiring the Work Permit;

- Acquiring the Resident Permit.

1) Chinese Work Notice

Your company should work with your foreign employees to obtain the Chinese work permit before the work visa is acquired. Recently, the process for applying for a work permit and Visas has become simpler, with SAFEA (The State Administration of Foreign Experts Affairs) now in charge of everything.

Once the required documents have been submitted through SAFEA’s system, a three-tiered, points-based method is used to assess employees:

- Class A – Elite foreign talent

- Class B – Professional foreign talent

- Class C – Miscellaneous foreigners

Employees are first checked if they should receive direct qualification for a category, or if not, be categorized under a points-based system.

Direct qualification

If an individual has characteristics like receiving an international award or applying for a government-encouraged job, they can be directly classified as A-Class. Those employees that hold a bachelor’s degree and have at least two years of work experience should be put in the B-Class. Finally, if the employee is in China for a temporary, short period of time, they should be put in the C-Class.

Points-based qualification

SAFEA also uses a points-based classification method for categorizing potential foreign employees in China. For a detailed explanation of this process, see this article.

2-3) Turn in Work Permit Notice and Z-Class Visa application

Take the work permit received and the Z-visa application to the appropriate Chinese Embassy/Consulate for the area. It is important to note that the Z-Visa only lasts for 30 days.

*If you are in the U.S., the application should be personally be turned into the appropriate Chinese Embassy/Consulate for the State in which the employee lives. If it is inconvenient to go to the Embassy/Consulate personally, a third-party service

Here is a complete list of Chinese Diplomatic Outposts around the world.

4) Receive the Visa and get on the plane to China!

The expectation as the company doing the hiring is usually to provide the flights for the employee and their family.

5) Temporary registration with Police (Must be done within 24 hours of arrival to China)

If a foreign employee chooses to stay at a hotel, the hotel can register on their behalf, usually with only their passport. Otherwise, if they rent an apartment, they must register with the local police station themselves.

6) Medical Verification (Must be done as soon as possible upon entry into China)

There is an International Travel Healthcare Center in every major city in China. This Chinese Government Website contains the complete list. Chinese authorities will not accept an English version of one’s medical report from abroad, so if an employee would like to use theirs from back home, it must be translated into Mandarin. However, many employees choose to get a new medical check once they arrive in China.

7) Acquiring the Chinese Work Permit

Next, the employee should acquire the Work Certificate. The appropriate documents should be submitted to the Ministry of Human Resources and Social Security, the processing time is typically 10 business days.

8) Acquiring the Chinese Resident Permit

To finally receive this, the employee must go in person to the local Exit-Entry Administration Bureau. The processing time will be 7 business days. The Exit-Entry Administration Bureau will keep the employee’s passport during this time period, the employee will receive a receipt that serves as a temporary one.

Without a resident permit, a foreign employee cannot stay in China long term. Although there are a lot of steps to obtain a resident permit, the consequences of not following the proper legal procedure are serious. Here’s an example case:

The Consequences of Illegal Employment

The government noticed that a company in China was illegally employed foreign workers and engaged them in language training. The employer did not comply with the relevant policies and provided employment and residency to foreign workers illegally. Additionally, the employer also signed labor contracts privately with foreigners.

Consequently, the local authorities terminated the illegal employment and imposed a fine of 8,000 RMB on both the employer and foreign employees. At the same time, foreign employees who failed to get the work permit and residence permit were given limited-time visas.

According to Exit-Entry administration law of the People’s Republic of China, for foreigners who obtain employment illegally, a fine of not less than 5,000 RMB but not more than 20,000 RMB shall be imposed; if the circumstances are serious, he or she shall be detained for 5 to 15 days and fined from 5,000 RMB to 20,000 RMB.

Employment Taxation & Contributions

As a company interested in hiring foreign employees as your employees in China, it is valuable to have some understanding of China’s individual taxation laws. It is recommended to work with a tax law specialist to create a strategy to determine the most profitable way forward.

Chinese Individual Income Tax (IIT) Qualification

To determine how much of a foreign employee’s income is subject to Chinese taxation, there are several factors that must be considered to classify employees into several different classes:

Class one: Residing less than 90 days in a tax year

Foreign employees who have worked in China cumulatively or continuously for less than 90 days are only taxed on income earned from Chinese companies while working within China. Income earned from foreign companies and/or earned outside of China is exempt. If China and the foreign employees’ home country have a double taxation agreement, the 90-day time limit can be extended to 180 days. Here’s a full list of countries with which China has this agreement.

Class two: Residing for more than 90 days but less than one tax year

This second kind of employee is subject to IIT tax on all income earned while in China, both earned from Chinese and foreign companies for her or his work in China. However, income earned from work overseas is still exempt.

Class three: Residing for more than one year but less than six years

At this point, it is worth noting that a period of residency is based on the calendar year, excluding temporary absences from China up to days cumulatively or 30 days continuously.

For those employees who have resided in China more than one year but less than six years, all their China-sourced income and income paid by a Chinese employer during a temporary absence from China will be subject to IIT. However, if the employee is employed by a foreign employer and the employee takes a temporary leave of absence from China, any income earned from their foreign employer while overseas is not taxable in China.

Class four: Residing for more than six years consecutively

Starting from the sixth year of consecutive residence in China, foreign employees will be under identical tax liabilities as Chinese citizens. They will be taxed in China on all income earned, whether within China or overseas, whether from a Chinese employer or foreign employer.

This brings up an important consideration for foreign employees. In order to avoid paying Chinese taxes on all their worldwide income, employees should not stay in China for more than six consecutive years. To reset the six-year count to zero, they should either spend consecutively more than 30 days outside of China or cumulatively more than 90 days in a calendar year. A calendar year is defined as January 1st to December 31st, so if a foreign employee arrives to work in China on July 1st, they will complete their first year in China on December 31st.

China’s Individual Income Tax Contributions

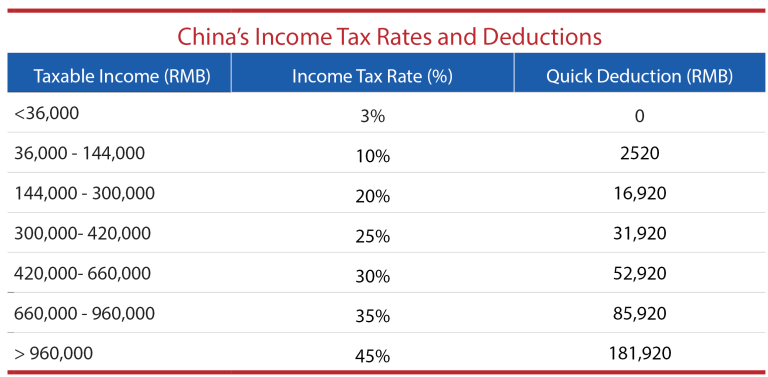

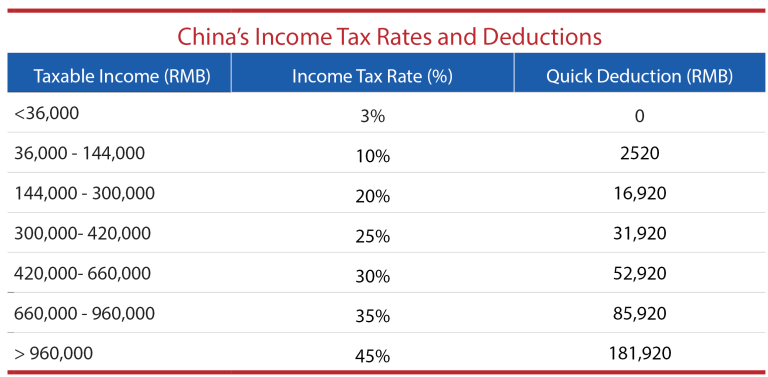

Income in China is taxed at progressive rates. Following is a table showing the different tax brackets, including Quick Deduction figures, enabling you to reach the total tax payable by entering the full income into the highest applicable tax rate, then subtracting the quick deduction figure. The table is given in terms of year-long income.

For foreign employees in China, a standard deduction of RMB 5,000 per month is given. There are many other allowances that can also be deducted from an individual’s income, including

- Furthering their education;

- Expenses for children’s education;

- Home mortgage interest;

- Medical treatment for critical illness;

- For employees who are not paying a mortgage, house rental in the main working city;

- Support for the elderly.

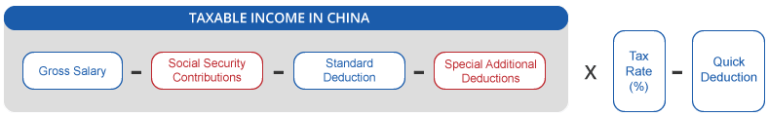

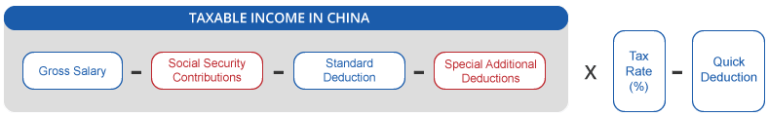

Here are the formulas for IIT payable:

Social Security in China

The Chinese Social Security system is divided into two parts. The five social insurances make up one side, while the housing fund makes up the other.

Social Insurances

- Pension – Both employer and employee must contribute. The employee’s part goes into a personal account so is considered personal property. The employee must work at least 15 years before the pension cannot be drawn upon.

- Work Injury – The employer covers this benefit completely. It can cover wages for up to 12 months, as well as medical expenses.

- Medical – The State heavily subsidizes this category, but the employee and employer both will still contribute. It cannot cover all expenses or treatments, and the employee’s dependents are not covered.

- Unemployment – The employee and employer both contribute. In China, it is considered obligatory insurance and can cover unemployed urban workers for up to 24 months.

- Maternity – The employer contributes to this fund, it covers loss of earnings and medical expenses for no less than 90 days.

The Housing Fund

The housing fund is a feature of the Social Security package that is unique to China. It is designed to encourage employees towards homeownership, through a half and half contribution to an individual fund that can be drawn upon by employees when they want to pay things related to homeownership, whether a down payment or payments on a mortgage.

The contribution amount for both the employee and employer is anywhere from 5% to 25% of an employee’s income. The amount saved up in the housing fund can also be distributed to an employee when they retire.

Contribution to the housing fund is only mandatory in state-backed companies, in private companies it is optional. Many foreigners don’t realize that they can also make use of the housing fund, just like a regular Chinese worker. As an employer, your company can use the housing fund to further incentivize foreign employees to work in China. It is important to understand that the expected contribution amounts to the housing fund vary from city to city, so an accurate understanding of the relevant rules is critical.

Creating a Labor Contract in China

The foreign employee and the employer must sign a labor contract. The duration of the contract shall not exceed 5 years. The contract may be renewed in accordance with the law of the People’s Republic of China.

What to include in the labor contract?

- The date of signing, Term of Contract and Probation period;

- Employee’s and employer’s address details, official identification, and signatures;

- Job title, job description, and work location;

- Labor protection and working conditions; [fusion_menu_anchor name=”section7″ class=””][/fusion_menu_anchor]

- Compensation, benefits, and insurance information;

- Termination conditions;

- Breach of contract provisions & disciplinary rules;

- Other provisions such as Training Bond, Non-disclosure agreement, and Non-compete agreement;

These are general guidelines for the labor contract, however, because a labor contract is considered a legally binding document, having it drafted professionally is the usual option companies choose. This is a service HROne can help with!

..

Salary Package for Foreign Employees in China

The salary package for foreign employees typically includes a base salary, bonuses, social insurance, additional international insurance for the whole family in China, rent allowances, school expenses for children, once or twice a year round-trip home flights, transport allowances, stock options, and business expenses. The company also pays for visa processing and related expenses.

It is also important to understand that the process for drafting an employment contract is process-intensive, and so should be drafted professionally to avoid numerous legal pitfalls. For Chinese legal purposes, a foreign-drafted labor contract is not considered adequate.

How to Structure a Salary Package

Structuring a salary package so that it provides the greatest incentive to employees while also remaining legal under Chinese law is an important consideration before hiring. Regarding hiring foreigners, incentivizing them to move to China takes planning. They should be compensated in a way that allows them a similar standard of living to what they have come to expect in their home country. Additionally, the gross salary should be considered with regard to China’s Individual Income Tax (IIT) rules.

One of the best methods for encouraging foreign employees to live in China is through offering allowances. These can include many areas of compensation, including:

- Housing charges;

- Relocation costs;

- Daily meals;

- Annual round-trip airfares to home country;

- Business travel expenses;

- Tuition fees.

The employment contract between the foreign employee and hiring employer should include a complete breakdown of the allowances. A typical salary package is 30 percent made up of such allowances. There is no hard and fast Chinese law about how much of the salary can be made up of allowances, but because that 30 percent threshold has been established, it is not recommended to exceed it.

The majority of foreign employees are not eligible for most types of Social Security in China, so many choose to enroll themselves in private insurance.

Privileges of Foreign Employees

The same rights and privileges are given to Chinese citizen employees are also given to foreign employees. They include:

- Hygienic working conditions;

- Earning the minimum wage;

- Vacation and rest benefits;

- Legal work hours;

- Other privileges provided by the law.

The only difference in the privileges given to foreign employees is that they are not allowed to find work just anywhere in China. They are only allowed to work in the same area as provided in the work permit. If the need to change the location of the job arises, the foreign employee and their employer must apply for a new work permit.

Now, on to some employee-centered information. How can your company attract employees to work in China? What are some of the common challenges faced by foreign employees?

How to Attract Foreigners to Live in China

Although there are challenges facing foreigners who want to work and live in China, there are certainly benefits. Here are some main selling points to potential employees:

- The international experience that can be gained by working outside their respective countries is quite valuable, especially for employees who do not reside in China;

- The salary packages offered to foreigners working in China is usually higher than it would be working within their native country. This is a strong motivational point to convince employees to come to China to work;

- Greater job scope than a candidate’s current position. Foreigners are often attracted to positions able to challenge them and develop them more;

- Personal career development;

- Interesting new opportunities within China’s rapidly growing technology sectors;

- The chance to develop more personally as well as professionally, especially if a company can provide good professional training.

Hiring foreign employees who are not already living in China can also be a great chance for your company to assign talent to non-tier 1 cities. Foreigners who have already been living in China may be too comfortable in Tier 1 cities such as Shanghai to want to move to a less-developed, though faster-growing area. Hiring foreign employees can be a good chance to diversify into lucrative new markets.

Challenges Foreign Employees Living in China Face

For foreigners, relocating to China can be a big adjustment. Although the country has become much more modern in recent years, there are still big differences between living in China and in the west.

Language

One of the biggest is the language barrier. It is somewhat ironic that the most widely natively spoken language in the world is also one of the most difficult to learn. However, the good news for westerners is that many Chinese people can speak English. Especially in big cities, specifically Shanghai, Beijing, and the Pearl River Delta region (Guangzhou, Shenzhen, Hong Kong), English is widely spoken, and it is easy for expatriates to live and get around.

Cultural Differences

Confucianism is deeply embedded in Chinese culture. In this set of beliefs, a good life is built around understanding one’s place within society and shaping one’s behavior appropriately. For example, within an office, behavior, and attitude toward the boss should be far different than towards coworkers. It is important for foreigners to seek to learn and adapt humbly to Chinese norms.

Besides Confucianism, types of food are another major cultural difference. Healthy foods such as salads and smoothies can be hard to find because traditionally Chinese consider most kinds of food to be healthy. But, because of the westernization of many major cities on the East coast, foreigners can still find foods to suit their tastes.

How business is done in China

Business in China is done differently than in other nations, and therefore international standards are not always followed. To successfully immerse themselves in Chinese business culture, foreigners should seek to adapt to the Chinese style. For example, to many Chinese people, a “yes” or a “no” is not taken at face value. Rather, it means that they want to negotiate. Also, Guan Xi, meaning personal connections, is incredibly important in China. It is valuable to understand that there are underlying personal complexities to business relationships.

What HROne can Offer Your Company

HROne has many years of experience operating in the Chinese market, helping foreign firms achieve successful market entry and beyond. As you know from reading this article, the process involved with hiring foreign employees in China is complex, and the rules have changed frequently in recent years. Our experienced specialists can walk your company through the whole way.

In addition to helping your company hire employees, we can assist with administrative tasks such as taxation, entity set up as a WFOE (Wholly Foreign-Owned Enterprise), and office space rental. Contact us to get started on your journey to China!

Get the guide to hire employees in China in 2021 and stay updated on the latest news about HR, employment, and business expansion in China!

Thank you!

You have successfully joined our subscriber list. Check your email to get your copy of the guide to hire employees in China!