Employer of Record

What is EOR / Employer of Record?

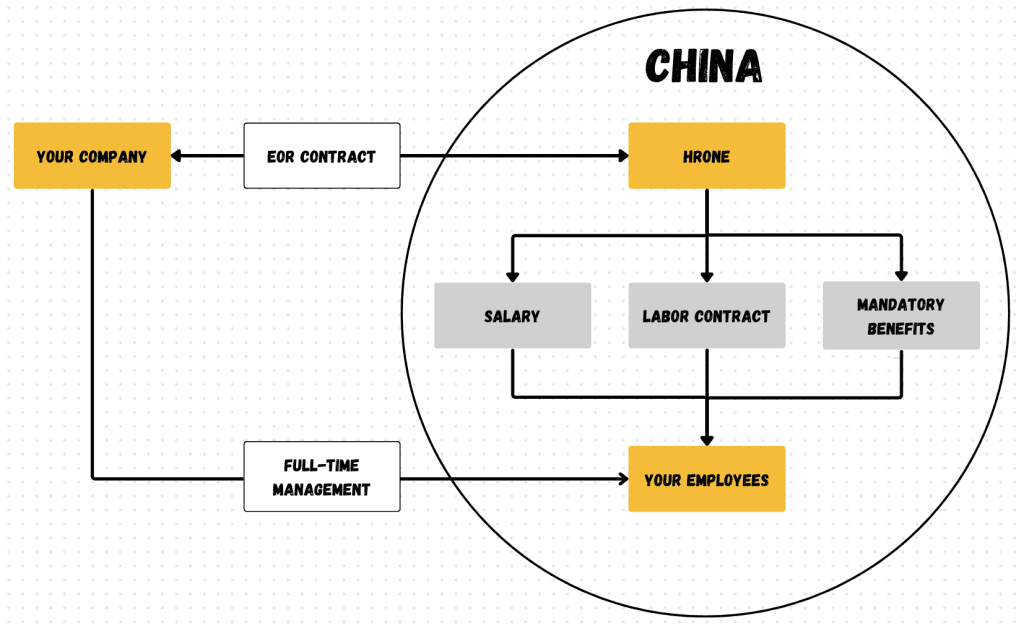

EOR, short for Employer of Record, is a third-party service provider that hires employees on behalf of another organization; the EOR service provider appears on the legal employment contract but does not directly manage the employees. Even when using an EOR, statutory benefits must be secured.

It is also known as employment outsourcing. It has been widely used as a flexible hiring practice for global business expansion.

EOR can Happen for Many Reasons

- An organization that only need remote workers

- No employment qualification (i.e. Rep Office)

- Not enough hiring headcount but urgently need a team

- Outsourcing employment to save operational costs

- Team is too small to have an internal HR function

- Downsizing in China, retain a core team for HQ decisions

- Relocation & keeping the core team in China

How EOR Works ?

Normally, the organization would first need to engage a third party EOR agency; after the contract is made, the agent would confirm the information of the employees to be onboarded, prepare the employment contract accordingly, and establish a legal relationship.

The agent would need to handle the monthly employer responsibilities such as payroll, expense report, commission/bonus calculation, and social security contributions (5 insurances and housing funds); as well as the annual responsibilities such as annual bonus, individual income tax filing, etc.

If the organization plans to terminate the service with the employee, it would need to inform the EOR agency in advance so that the latter can prepare the dismissal process and payment involved. For expat, an EOR agency is also supposed to sponsor visa and residence permit.

Outsource your Employment in China

HROne is a one-stop HR solution providing services from hiring to comprehensive HR admin. Partner with, and trust HROne, your employees will be in good hands.

Compliance

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

HR Tech Solutions

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Industry Experience

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Employer of record Cases

EOR as a Business Solution

Hiring a sourcing manager in China

Many companies are looking for experienced and bilingual sourcing managers in China that are well connected to suppliers in their industry. These professionals also handle QA & shipping out of China for their employers.

Hiring a sales representative in China

Many companies are looking for experienced and bilingual sales representatives to find potential buyers in China and pitch their products or services.

Supporting a client project in China

Companies engaged in long-term projects with clients in China often opt to hire a qualified local talent in China to get the work done as opposed to flying people to China or relocating employees to China. This is most common with construction engineers among others.

Pre-Entity Setup

For businesses planning to establish a presence in China, our EOR service is invaluable. It enables the deployment of a pre-opening team to oversee the entity setup process, conduct market research, and initiate other preparatory activities.

Relationship Management

Ideal for companies that require a small local team to manage business relationships within China, such as sourcing operations or software development, without the necessity of establishing a Chinese entity.

Post-Entity Closure Operations

After closing a Chinese entity, businesses can continue to maintain a small team through our EOR service to manage any remaining business engagements.

Company restructuring

Companies that go through mass layoffs, closures or restructuring in China oftentimes use HROne's Employer of Record services to retain essential employees employed in China after closing the company or choose to outsource their labour administration to lighten overhead costs.

Hiring as a Rep Office

Representative offices may only hire up to 10 employees. However, even these employees cannot be hired in-house and their employment must be outsourced to a local EOR service provider.

Testing the market

Explore the Chinese market without taking on the costs and risks of setting up an entity. We can hire employees for you so you can evaluate the readiness of the Chinese market without making a substantial investment.

Reimbursement for Outsourced Employees

Expense Claim Solutions at HROne

Solution #1: Global Reimbursement

Clients engage with our global partner to facilitate reimbursement payments. Upon signing a new service contract, HROne oversees the bill collection process. Reimbursement applications are streamlined to exclusively accommodate transactions in US dollars, with strict adherence to a monthly cap of USD 5000 per individual.

Pros:

- Exemption from VAT

- Flexibility to client-specific reimbursement

Cons:

- 10% service fee, or a minimum of USD $100.

Solution #2: Integrated Reimbursement and Salary Structure

This solution integrates reimbursements with regular salary disbursements, providing clients the option to absorb individual tax obligations. While this approach alleviates service fees associated with expense claims, employees may incur higher Individual Income Tax (IIT) burdens.

Pros:

- No service fees

Cons:

- Higher IIT due to inflated salary.

Frequently Asked Questions

Payroll & mandatory benefits are included in our China Employer of Record and our PEO services.

In many countries, PEO and EOR are the same thing and can be interchanged. However in countries such as China and the USA, PEO and EOR refer to different services:

With Employer of Record (EOR), the service provider takes on the responsibility & liability of the employer since the client does not have a legal entity in the country of interest.

With Professional Employment Organization (PEO), the service provider manages hiring, employment and payroll, but does not take on the responsibility or liability of the employer since the client has a legal entity in the country of interest.

The 13th month bonus in China refers to a bonus equal to one month’s salary that is usually paid at the onset of Chinese New Year.

This 13th month bonus is not mandatory unless explicitly stated in the labor contract upon signing. A 13th month bonus depends on the company’s performance as well as the employee’s performance.

It is possible for employees to receive an even higher bonus (14th or even 15th month bonus) depending on these factors.

Employees in China are entitled to annual leave days based on their work experience.

After working for their employer for 1 year. Employees who have worked less than 10 years are entitled to 5 days paid annual leave.

Employees who have between 10 and 20 years of experience are entitled to 10 days paid annual leave.

Employees with over 20 years of experience are entitled to 15 days of paid annal leave.

Using an Employer of Record/PEO service is often regarded as the modern approach to expanding into China. As long as you do not need to invoice in China, this is a perfect solution for foreign SMEs that want to start their business here. With an employer of record, you can legally hire and manager your team in China, avoiding the time and money required to set up a company.

HROne, the Employer of Record, is legally responsible for your staff during their term of employment in China.

We can hire a local Chinese employee in as little as one day!

Your staff members can be employed and located anywhere in China. Their employment status will be recorded by the local bureau according to their location.

Not necessarily. Staff members can work remotely from home or another location. However, we offer office space rentals upon request.

Yes, our Employer of Record solution can be used to hire both local and foreign staff.

Individual income taxes In China are based on a progressive tax brackets rate:

| Bracket | Annual Taxable Income (RMB) | Tax Rate (%) | Quick Deduction |

| 1 | No more than 36,000 | 3 | 0 |

| 2 | Between 36,000 and 144,000 | 10 | 2,520 |

| 3 | Between 144,000 and 300,000 | 20 | 16,920 |

| 4 | Between 300,000 and 420,000 | 25 | 31,920 |

| 5 | Between 420,000 and 660,000 | 30 | 52,920 |

| 6 | Between 660,000 and 960,000 | 35 | 85,920 |

| 7 | More than 960,000 | 45 | 181,920 |

Social benefits in China are divided into two categories:

- Five mandatory social insurances – These include pension insurance, medical insurance, unemployment insurance, work-related injury insurance, and maternity insurance.

- Housing fund – The purpose of this is to allow employees to save money to buy a house in China.